Transforming Telecom: Key IT and Digital Investment Areas Shaping the Industry

Telecom companies are increasingly reliant on IT and digital solutions to meet the growing demands of their customers and stay ahead of the competition.

Effective allocation of resources in IT and digital areas is crucial to telecom company performance. The appropriate investments can result in higher operational efficiency, better client experiences, and more revenue sources.

However, it is critical to strategically target the areas that will have the greatest impact and to manage the risks connected with them.

Digital Transformation in Telecom

The telecom sector has expanded beyond traditional phone and text services to include a wide range of digital services such as internet access, multimedia streaming, and others.

The telecom industry must allocate resources effectively to adopt 5G technology, and IoT devices, and use data analytics to remain competitive.

The telecom industry’s digital transformation relies on IT and digital solutions. They allow for the modernization of network infrastructure, the creation of new services, and the improvement of client relations.

IT & Digitalization Spending Patterns in Telecom

The telecom sector has seen the emergence of several significant digital and IT trends, positioning it to develop new features for business and personal communication.

1. Network Virtualization

The transition to virtualized, software-defined network infrastructure is game-changing. It distinguishes between hardware and software, increasing flexibility and scalability.

Software-Defined Networking (SDN), Network Functions Virtualization (NFV) for virtualizing network functions, Cloud-Native Network Functions, and Edge Computing, which reduces latency in 5G networks, are key components.

2. Customer Experience and Engagement

Personalization is a cornerstone of customer experience, enhancing satisfaction. Key components include:

- CRM: Modern CRM systems manage customer data and enable targeted marketing.

- Data Analytics: Leveraging big data for insights into customer behavior.

- Self-Service Portals: Empower customers to manage accounts and access support as swift issue resolution is vital:

- Machine Learning and AI for real-time issue detection.

- Proactive customer support with maintenance notifications based on AI and ML.

3. Analytics and AI

Telecom businesses are investing in modern data analytics platforms, such as Hadoop and Spark, as well as centralized data storage and predictive analytics.

Furthermore, AI transforms network optimization by detecting equipment breakdowns, optimizing traffic routing, and improving QoS.

AI and data analytics enable churn prediction, personalized suggestions, and successful marketing segmentation by driving customer insights.

The global AI market in telecom stands at US$ 2.49 Bn in 2023. It is expected to reach US$ 6.60 Bn by 2026 at a CAGR of 38%.

- Use case 1: Smartfren Telecom collaborated with Mobileum to monitor and analyze network factors such as traffic volume, latency, throughput, and quality of service, as well as to identify and rectify any issues that may impact end-user satisfaction.

- Use case 2: Airtel is using the conversational AI toolset NVIDIANemo from Nvidia to accurately comprehend language and make meaningful adjustments to their customer support operations.

4. D. IoT and 5G Adoption

The global IoT market in telecom stands at US$ 9.54 Bn in 2023. It is expected to reach US$ 23.26 Bn by 2026 at a CAGR of 5.98%.

IoT necessitates investments in platforms, devices, and security, whereas 5G is disruptive and necessitates investments in spectrum, infrastructure, and ecosystems.

The global 5G market in telecom stands at US$ 134.1 Bn in 2023. It is expected to reach US$ 264.10 Bn by 2026 at a CAGR of 25.3%.

5G enables sophisticated applications such as smart homes and cities by providing ultra-high speeds and integrated computing and storage.

It expands telecom offers beyond traditional services by increasing network capacity, enabling IoT growth and SIM smart gadgets to become the standard.

- Use case 1: BT with AWS will provide new solutions for the IoT and Mobile Edge Computing (MEC) industries. The collaboration will use BT’s network and AWS’s cloud to provide value-added services to businesses across multiple industries.

- Use case 2: HFCL and Microsoft will collaborate to provide private 5G solutions to businesses by using the Azure platform and HFCL’s 5G RAN devices to provide high-speed, low-latency, and secure connectivity for a variety of business verticals.

5. E. Cloud Services

Cloud services and edge computing are critical for scalability and flexibility. Companies in the telecommunications industry invest in cloud infrastructure, edge data centers, and cloud-native apps.

Active money inflows into the development of cloud services characterize digital transformation. Earlier, cloudification infiltrated internal infrastructure, growing to prominence as a dependable option entailing the migration of business support systems to the cloud.

The telecom cloud market stands at US$ 14.16 Bn in 2023. It is expected to reach US$ 26.40 Bn by 2026 at a CAGR of 23.1%.

- Use case: AT&T collaborated with Google Cloud to provide 5G-enabled edge cloud computing services to boost speed and minimize latency for real-time processing applications.

Tech Investment and Focus Areas in Telecom

Given the everyday necessity, businesses rely on a comprehensive telecommunications network to ensure effective and efficient communication between employees, workers, and clients.

Businesses can have a better awareness of and control over the costs associated with their current telecom network by using integrated network management.

The primary goal of integrated network leadership is to build an error-free, high-performing network.

Integrating IT and network services allows telecom companies to respond to shifting customer expectations, which is a competitive prerequisite. As a result of the lower costs, they have more options to invest in unique abilities, ultimately saving time and capital.

Opportunities created by new technology have the potential to generate trillions of dollars in new economic value worldwide.

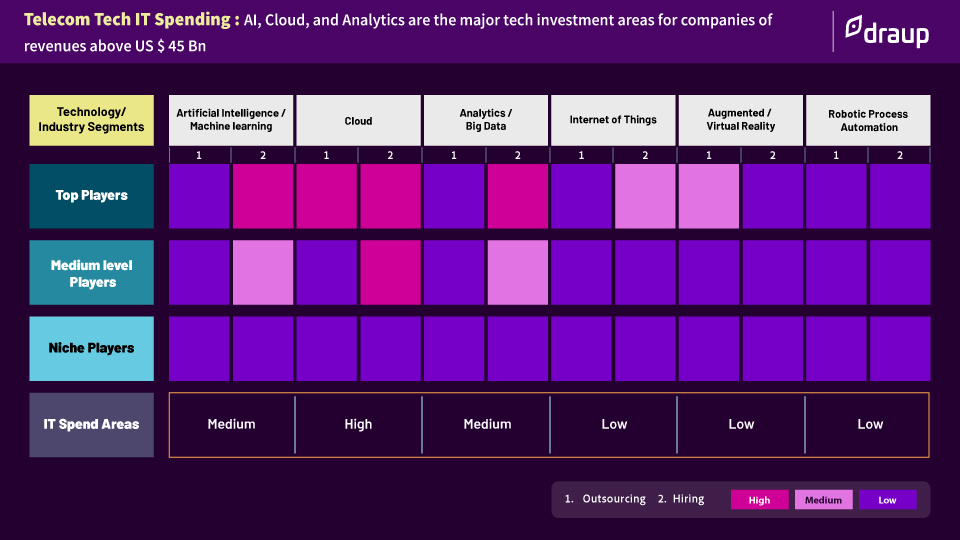

The telecom industry is primarily focused on a few initiatives that fall into three categories: AI, cloud computing, and analytics/big data. Telecom businesses and service providers are working together to bring new value to the market.

The below infographic showcases its focus areas:

Draup conducted comprehensive research into the telecom sector. Its context-rich presentation offers information on priority areas, industry forecasts, opportunity areas, etc.

The research also lists service provider insights, key business initiatives, and IT spending areas.

Draup for Sales provides account intelligence and real-time sales signals to sales teams so they may progress various initiatives and uncover niche outsourcing opportunities.