The Semiconductor Roadmap for 2023 and Beyond: The Future of an Evolving Industry

The semiconductor industry has experienced unprecedented growth, driven by the proliferation of smartphones, the advent of the IoT, and the demand for high-performance computing.

In 2023, the global semiconductor market reached a record-breaking US$ 612.43 Billion, showcasing the industry’s resilience and importance in the modern digital economy.

It is expected to grow at a CAGR of 7.1% to reach US$ 990 Billion by 2030, buoyed by Moore’s Law, which posits that the number of transistors on a semiconductor chip doubles approximately every two years.

Each year, the industry experiences remarkable advancements pushing the limits of computing power, connectivity, and energy efficiency, despite complex manufacturing processes, supply chain disruptions, and increasing demands for energy-efficient designs.

The Semiconductor Roadmap

In 2023, the semiconductor industry will focus on advanced process nodes and lithography. Leading manufacturers may introduce 3nm and 5nm nodes for higher transistor density and performance. These advances will enable processors, memory modules, and SoC designs.

Packaging and interconnect solutions will also shape the semiconductor roadmap. Chiplets, 3D integration, and fan-out wafer-level packaging (FOWLP) are developed to improve bandwidth, power consumption, and reliability.

These packaging innovations enable miniaturization and integration, making devices smaller and more efficient.

The semiconductor roadmap will prioritize power management and efficiency. Modern electronics struggle with heat and energy consumption. Adaptive voltage scaling and dynamic frequency scaling will improve energy efficiency and battery life.

Implications of Trends and Directions for Semiconductor

It is important to consider long-term trends and directions that will shape the industry.

Quantum computing: It will revolutionize computation using quantum mechanics. Quantum computing uses qubits, which must be precisely controlled and manipulated.

Building reliable quantum computing platforms requires high-coherence and scalability qubits, and semiconductor materials are being investigated.

AI and neuromorphic computing: Neuromorphic computing mimics the brain to process data efficiently. They use neural networks to perform pattern recognition, sensory processing, and cognitive computing with high energy efficiency.

Neuromorphic chips, which accelerate AI algorithms and enable real-time, low-power, edge-based AI applications, require semiconductors.

Internet of Things (IoT) and edge computing: Connected devices and IoT applications require edge data processing. Edge computing requires high-performance, low-power semiconductors.

Semiconductor manufacturers can enable intelligent edge devices with real-time data analytics, privacy, and security by integrating sensors, processors, and connectivity on a chip.

Advanced sensors: LiDAR, radar, and biosensors will enable autonomous vehicles, robotics, and healthcare. High-performance sensors with improved sensitivity, accuracy, and miniaturization require semiconductor materials and fabrication methods.

Sensor fusion will improve perception systems, enabling autonomous systems and immersive experiences.

AR and VR applications: AR and VR are being rapidly applied in gaming, entertainment, training, and simulation. These technologies require high-performance processors, advanced graphics, and low-latency communication.

Semiconductor companies are developing chips and platforms for AR and VR applications to provide realistic and immersive experiences.

Market Trends and Potential Growth Opportunities

The semiconductor industry is poised for continued expansion and numerous prospects:

1. Electric and autonomous vehicles: Power management ICs, motor control chips, and battery management systems are key semiconductor components in EVs. Semiconductor manufacturers will aid transportation electrification as EVs become more popular.

Besides, level-three autonomous vehicles are a major semiconductor industry trend. Automotive semiconductors can improve EV battery performance, sensors, and connectivity.

2. 5G communications: 5G chipsets allows faster information Semiconductor technology will meet new standards in this ecosystem.

3. Consumer electronics: Consumer electronics drives the semiconductor manufacturing equipment market. Electronic device chip sizes and architectures have increased semiconductor demand.

4. Advanced materials: The semiconductor industry uses silicon carbide and gallium nitride, which have a wider bandgap and offer high voltage resistance, higher operating temperatures, faster switching, and a smaller form factor.

In the five years to March 2026, Mitsubishi will invest approximately JP¥ 260 Billion (US$ 1.86 Billion) to build a new wafer plant to meet the rising demand for silicon carbide (SiC) power semiconductors.

5. Healthcare and medical devices: Semiconductor advances enable innovative medical devices, precision diagnostics, telemedicine solutions, and personalized healthcare. It is improving patient care, disease management, and medical research.

6. Industrial automation: Robotics and smart manufacturing depend on the semiconductor industry. Semiconductor-enabled machine vision, robotics control, and industrial IoT improve manufacturing and logistics efficiency, productivity, and safety.

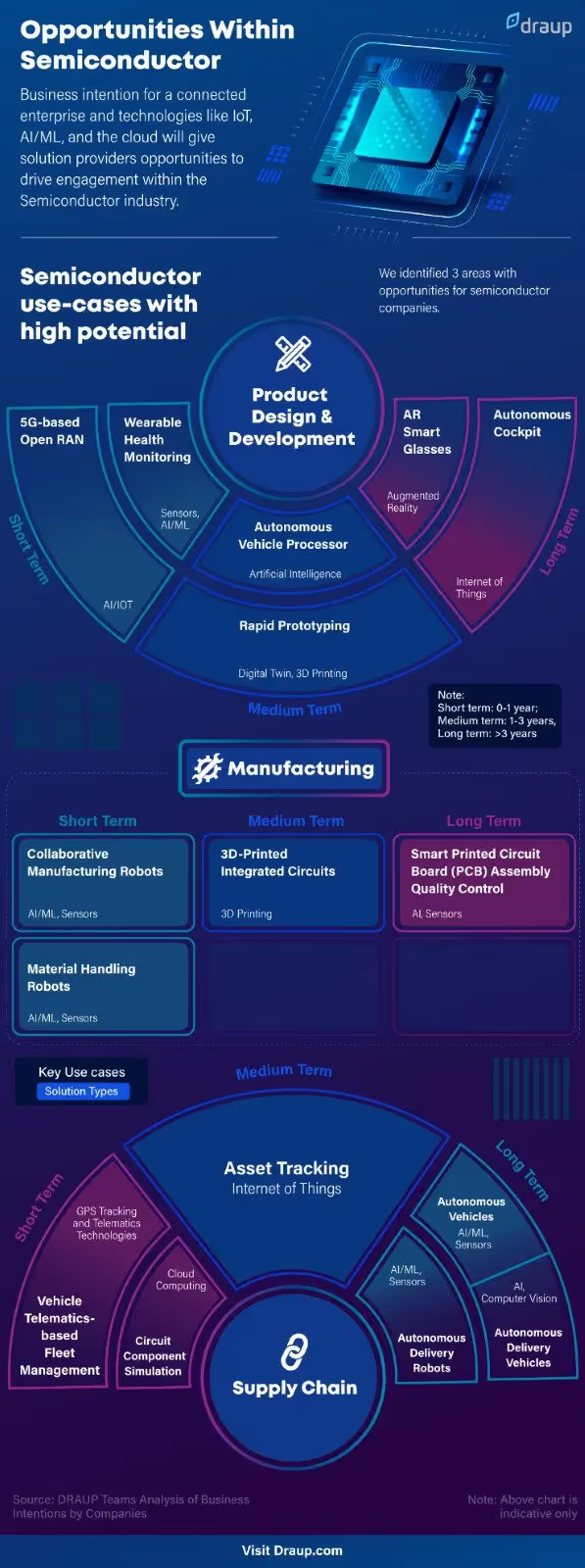

The below infographic identified three business intentions, namely, product design & development, manufacturing, and supply chain, that are enhancing the industry in this decade.

Strategic Recommendations for Stakeholders

The semiconductor industry stakeholders should consider the following strategic recommendations in order to capitalize on opportunities and overcome obstacles.

- R&D investments: Continued investments in semiconductor R&D are essential to drive innovation, enhance manufacturing processes, and develop future-ready technologies.

- Collaboration and partnerships: Collaboration throughout the semiconductor ecosystem, including manufacturers, equipment suppliers, and research institutions, can foster knowledge exchange, drive technological advancements, and collectively address complex challenges.

- Acquisition and talent development: The semiconductor industry requires a skilled workforce to drive innovation. Through educational programs, internships, and training initiatives, stakeholders should seek to attract and cultivate talent.

- Sustainability: Adopting sustainable practices in the manufacturing and operations of semiconductors can reduce environmental impact, improve energy efficiency, and contribute to a greener future. Businesses should prioritize sustainability initiatives and develop eco-friendly solutions.

Conclusion

The semiconductor industry roadmap beyond 2023 promises exciting advances and transformative applications. The industry leads technological progress in advanced process nodes, packaging solutions, quantum computing, and neuromorphic computing.

With sales intelligence, stakeholders can navigate this dynamic landscape and shape the semiconductor industry by addressing challenges, seizing opportunities, and collaborating.

Draup for Sales is a sales intelligence platform that extracts, processes, and presents data on a dashboard. Sales teams get comprehensive insights that their competitors do not, equipping them with the necessary information to approach prospects.

With real-time intelligent insights, sales teams can —

- Filter data by deal size influence, budget control, personality traits, sales engagement guidelines, etc.

- Search by location, funding status, company size, leadership changes, etc., to hyper-target prospects.

- Track key signals with alerts and build clearer pictures of their target prospects.

- ML-based recommendation engines generate B2B leads.

Draup analyzed the opportunity propensity in the semiconductor industry. This report aims to provide a comprehensive analysis of the semiconductor industry outlook, key tech focus areas, opportunity areas for service providers, and more.

.svg)