Uber hiring Actuarial talent to boost safety standards

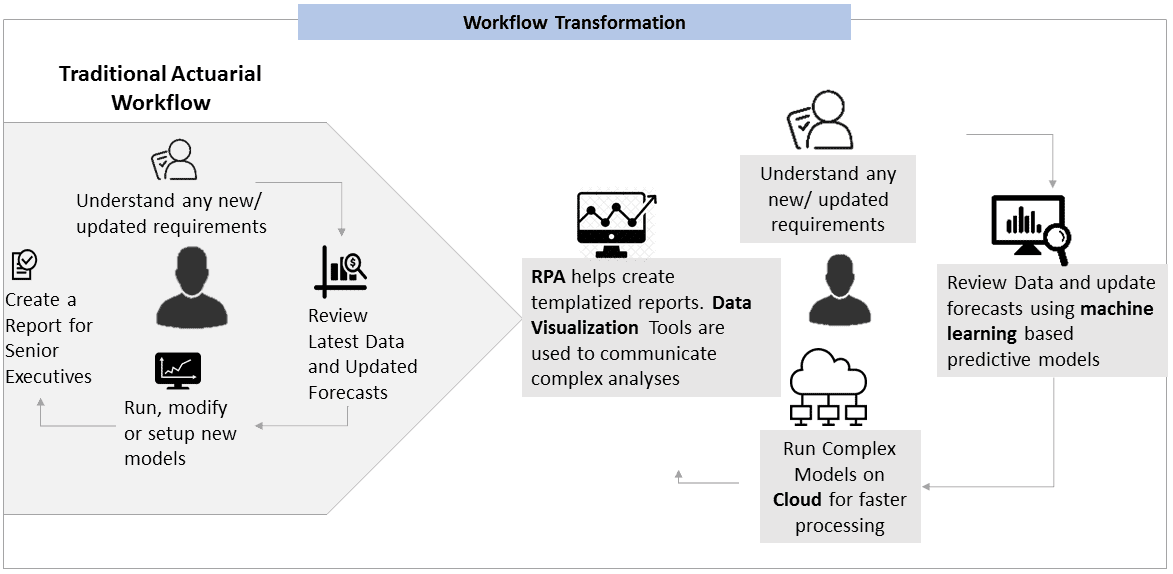

Harnessing the power of new-age technologies, actuaries are in hot demand than ever before, taking on new roles, working for new types of firms, and shaping the digital agenda. Firms like Google and Uber are hiring actuarial talents to address challenges surrounding risk assessment, risk management, and liability. Actuaries are the ideal choice to analyze and help manage these risks as the new-age actuaries are reskilling themselves with technologies like machine learning and analytics on top of mathematics and statistical skills.

Uber identified this aspect of using actuaries for non-traditional roles and formed a team of actuaries with data scientists and predictive modelers to enhance their safety features which include live location tracking, estimation of time of arrival, selfie test of drivers to discourage account sharing, KYC for riders and ML models and telematics to monitor driving.

Such new-age actuarial workloads will surge the talent demand beyond financial industry and hence organisations are leveraging reskilling methodologies to address new-age skill gaps for actuaries with just traditional skills.

What you should do now

- Request a Demo and see how Draup can help you plan, hire & skill your future-ready workforce.

- Read more free material about talent intelligence topics in our blog.

- If you know someone who’d enjoy this page, share it with them via email, LinkedIn, Twitter, or Facebook.