The traditional automotive industry has undergone a massive transformation with digital native technology providers across different industry segments playing a critical role. Smart Mobility, Autonomy, Connected Car and Electrification are the major technology-driven trends emerging across the industry.

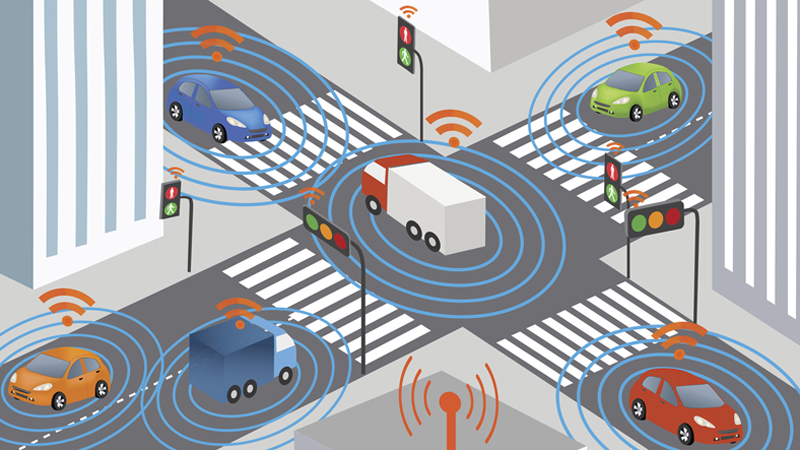

The autonomous segment in the automotive industry is seeing a major upswing due to factors like reduction in cost of Transport as a Service (TaaS), lowered government regulations related to testing and operations of autonomous vehicles in the US and significant advancements in Machine Learning technology. The current Autonomous Vehicle ecosystem has been rapidly growing through a rich infrastructure of network, cloud & insurance providers enabling new age business models.

A DRAUP study estimates the Autonomous industry to be worth $87 Billion by 2020 and enable potential savings of $2.2 Trillion in the areas of fuel efficiency, cost of life and productivity gains.

Digital Transformation of the Automotive Industry

“With increasing focus on digital engineering within Automotive, OEMs are prioritizing initiatives around connected and autonomous vehicles”

Around USD 8 billion is the Technology spending by the top 25 players in Autonomous vehicle segment. In-house R&D is focused on developing core software capabilities, leveraging deep learning for computing, vehicle control and vision-based perception.

The automotive industry, in general, and the autonomous vehicle segment in particular, is moving toward a new customer value proposition. Today, digital platforms are at the core of how customers figure out how to get from point A to point B. This makes it imperative for automakers to digitally transform their internal operations, service models as well as external partnerships.

While the automotive industry has always used information technology to achieve efficiency and scale, it is ripe for a digital disruption since the New age customer now uses a smartphone, is social media savvy and environment-conscious, and has become much more demanding in terms of speed and convenience.

This has led to the entry of AI / IoT native platform providers like Google and AImotive with strong AI capability that leverages deep learning algorithms required to make advanced driving systems safe and predictable. OEMs now have strategic focus on developing critical safety and driving systems in-house. OEMs such as Daimler, BMW and Ford are establishing partnerships with technology providers to collaboratively develop software capability for vision and perception systems.

Semiconductor giants such as Intel and Nvidia have developed specialised Autonomous Vehicle SoCs for processing and computing large amount of vehicle datasets using Machine Learning algorithms. While Traditional suppliers such as Bosch and TomTom have enabled advanced vehicle navigation and monitoring through specialised telematics equipment, new age suppliers have built capability into Advanced vehicle control using deep learning, sensor systems and connectivity services.

Well-funded start ups like Nauto, Argo AI and Drive.ai are the top players investing in full stack-Autonomous Vehicle solutions.

Changing Industry Structure

“Digital firms have disrupted the automotive sector across the value chain and as a consequence R&D focus has shifted to software”

In the traditional industry structure, Tier 1s and Tier 2s worked together to provide the Full-Stack of automotive solutions to the OEMs. This is now changing, with Tier 2s disrupting the traditional supplier relationship model to position themselves as a direct Full-Stack supplier of AV solutions.

For instance, Semiconductor giant Intel was traditionally a Tier 2 supplier who created ML/Deep Learning based microprocessors and sensor chips, and depended on Tier 1s like Continental and Bosch for sensors like LiDAR and RADAR, and 3rd party integration. In the new age industry structure, Intel directly offers full stack solutions related to autonomous vehicles – cameras, in-car networking, sensor-chips, roadway mapping, cloud software, machine learning and data management, to OEMs.

Intel accelerated its AV push through acquisition of Mobileye, bringing later’s core AV capabilities inhouse. Intel has now positioned itself as a full stack system integrator across vision systems, sensor technology and computing platform, and has also partnered with companies like Harman for its connectivity platform and Velodyne for its LiDAR technology.

The industry is also seeing more partnerships such as the one between Intel, Ericsson and GE to launch an open industry platform – 5G Innovators Initiative.

Challenges and Opportunities for Traditional Automakers

The automotive business is undergoing a transformation, leaving turmoil and uncertainty in its wake. Traditional automakers are dogged with concerns such as declining car ownership, flat revenues, new competition from non-automakers like Google and Uber, a new ecosystem of OEMs, suppliers and dealers, and changing government regulations. Auto sales are seeing a slowdown in all major markets including Europe, US and Japan.

This presents both challenges and opportunities for traditional automakers. In addition to investing more on profitable segments, culling declining segments and expanding into emerging geographies, it has become essential for OEMs to invest in “riskier” new age technologies such as autonomous and connected vehicles, ride sharing, electric vehicles etc.

DRAUP estimates the Engineering Services market in the Autonomous & Connected Car segment alone to be $215 Mn – $225 Mn.

A lot of automakers like GM, Toyota and Daimler are investing in ride-hailing companies, which act as a great platform to test their autonomous prototypes on.

Ford is an example of an automaker who was struggling with declining stock prices, flat revenues and decreasing profits. Ford was seeing low sales of their “Car” product line and declining growth rate even in their top geography, Northern America, due to a change in the customer mindset. This led to an R&D spend of $7.3 Billion in 2016, an aggressive increase of 9% over the previous year, on high growth areas such as Autonomous, Connected and Electric vehicles. Ford realigned its vision and strategy in 2016 to evolve from being an automotive company, to being an automotive and mobility company. While Ford is spending $4.5 billion to expand its EV portfolio by 2020, its investment of over $1Bn in AI, LiDAR, 3D mapping technologies and talent hiring from Silicon Valley, puts it ahead of the others in the Autonomy Landscape.

“Automotive firms will continue to gear up investments around autonomous capabilities as it becomes more mainstream “

Analyst firm IHS Markit predicts that autonomous cars will reach global sales of 600,000 by 2025 and 21 million by 2035. It is becoming apparent that those auto companies who focus on R&D spending and patents in non-traditional Business Units, realign their engagement strategy with the ecosystem, connect with new age digital suppliers and invest in engineering talent in new age technologies, will be ones who will stay competitive in the years to come.

Back

Back